High Priority Loans For Postal Employees

Here is an example of the specific rates and fees that would apply to your loan with WorkPlaceCredit. First because theres the security offered by being an employee of the government.

26 average number of payments.

High priority loans for postal employees. 2 nd chance auto refinance special. The Registered Agent on file for this company is C T Corporation System and is located at 208 So Lasalle St Suite 814 Chicago IL 60604. While these loans are not provided by promoted or sponsored by USPS we believe hardworking employees deserve access to quality loans.

Since 2010 High Priority Loans has been providing Nonclassifiable Establishments from Warrenville. Such loans can be taken for 1-3 years if the. It means that in this case the borrowers creditworthiness is more crucial than a car property or anything else used as collateral.

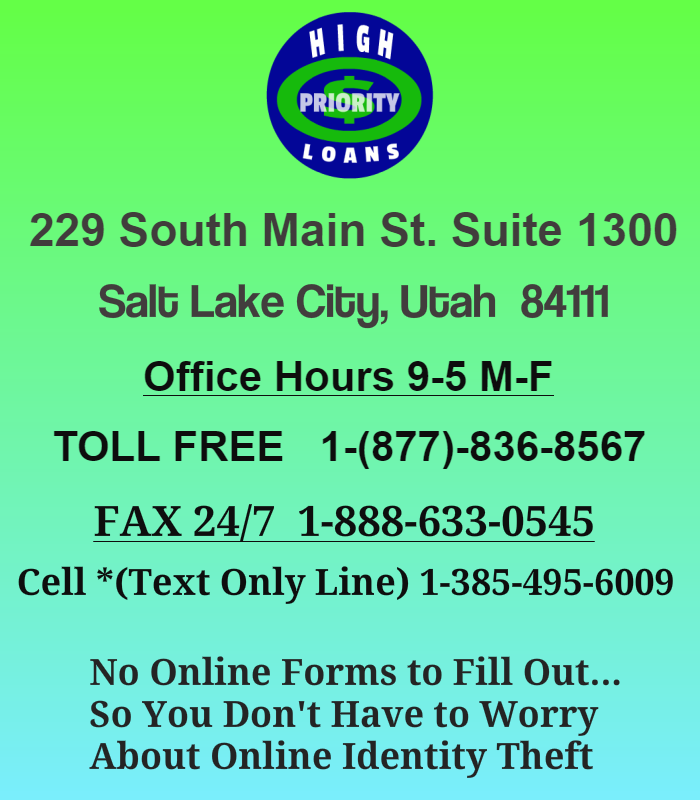

HIGH PRIORITY LOANS LLC. Retail value as low as. NO ONLINE FORMS TO FILL OUTSO YOU WONT HAVE TO WORRY ABOUT ONLINE IDENTITY THEFT.

We give hardworking USPS employees access to high-quality loans. Thats why we created Lendly. Your privacy is important to us.

They can count on personal loans which are unsecured. This is how you can get postal loans for up to 5 years. Post office loans for employees are a great option for those working in the industry to improve their financial position.

Get an emergency loan of up to 1500 minimum loan is 500 at an interest rate of 2999 with no origination fee and repayable over a period of 6 to 12 months. As low as 90 financing. If you are requesting a loan of 3000 an origination fee of 120 4 will be added to your loan amount.

How to SEND LOAN APPLICATION INFORMATION. The designated loan payments are then automatically deducted from your salary. Our competitive landscape shows how this business compares to.

Get Loans for Postal Workers. Coast 2 Coast Lenders provides small consumer installment loans to active employees of USPS and the Federal Government only. Qualification is often easier for government employees than those in private companies.

REVIEW The Requirements Below. The total amount of your loan would be 3120 which is financed at an interest rate of 2099 and 2518 APR. Up to 100 of nada.

As a postal employee you can think of joining this organization because it allows you to get better conditions when you are looking for some money. For example in Florida a 2000 loan with a one-time fee of 25 will be repaid through 25 bi-weekly allotment installment payments in one year will have an APR of 3222 and a bi-weekly allotment installment payment of approximately 95 with a total payback amount of approximately 2375 assumes a 11042020 loan execution date. Close-ended means that the contract has a specific repayment term with fixed periodic payments.

The companys principal address is 12333 Ridge. Type of loan. If You Have Any Questions 1-877-836-8567.

The companys filing status is listed as Involuntary Dissolution. Discretionary Allotment Loans for Federal Employees. In essence loans for government employers are high-priority loans for those lenders.

As low as. Fill in the Contact Form. SEND Documents Needed By FAX.

Other terms and conditions may apply including but not limited to loan. Installment loans for federal employees and postal workers are typical for bad credit borrowers. Should your chosen time frame for repayment be two years your payments of 7371 would be.

FEEA offers eligible federal employees confidential no-interest loans to help them bridge their financial gaps in times of emergency. 2000 maximum 12-months 700. Short terms limit risks for lenders.

Installment contracts are close-ended. 1000 average loan amount. So long as the borrower is a government employee theres a guarantee of loan.

Our similar businesses nearby shows similar businesses in their industry and region based on information found in their Dun Bradstreet Credibility Review profile. Just click on CONTACT US and give us a little information for one of our representatives to respond How Long Will It Take. Therefore postal workers can count on getting a loan whenever they need it.

Once we receive a completed application and documentation Coast 2 Coast will contact you within 24 hours with a. You can either get unsecured personal loans or a secured loan. 7007 average bi-weekly payment amount.

With an allotment loan you allot a specific amount of your salary to pay for a loan. Our Federal employee loan is a lifesaver. FEEA has given over 13000 no-fee no-interest loans since 1986 to help feds make ends meet during personal tragedies like illness death of a loved one or a house fire.

As low as. High Priority Loans LLC is an Illinois LLC filed on August 29 2006. Postal Service Federal Credit service is one of the options that you can consider if.

High Priority Loans is proud to be the premier loan provider for postal employees. Only one emergency loan can be active at any time. Installment loans come in many forms but only those with very short repayment terms fit bad credit borrowers.

We will never sell your information and we promise not to spam you. At the same time it may be difficult to find the best lending service provider among a large range of options available today. Installment Loans for Bad Credit.

Allotment Loans For Usps Postal Employees Cash Smart

Allotment Loans For Usps Postal Employees Cash Smart

Postal Loans Allotment Loans For Usps Postal Employees

Postal Loans Allotment Loans For Usps Postal Employees

Kashable Affordable Loans For Postal Employees

Kashable Affordable Loans For Postal Employees

No Credit Check Loans For Postal Employees Workfactoryloans

No Credit Check Loans For Postal Employees Workfactoryloans

Loans For Usps Employees Postal Workers Twentymilliseconds

Loans For Usps Employees Postal Workers Twentymilliseconds

Allotment Installment Loans For Federal Usps Employees

Allotment Installment Loans For Federal Usps Employees

Allotment Loans For Postal Employees No Credit Check

Allotment Loans For Postal Employees No Credit Check

Contact Us High Priority Loans

Contact Us High Priority Loans

Allotment Loans For Usps Postal Employees Cash Smart

Allotment Loans For Usps Postal Employees Cash Smart

Postal Loans Allotment Loans For Usps Postal Employees

Postal Loans Allotment Loans For Usps Postal Employees

Cash Loans For Postal Employees

Cash Loans For Postal Employees

Comments

Post a Comment