Does The Apple Card Build Credit

Apple is partnering with Goldman Sachs for the card which is optimized. User profile for user.

Apple Card Family Allows People To Share Apple Card And Build Credit Together

Apple Card Family Allows People To Share Apple Card And Build Credit Together

If the card issuer does not report your account.

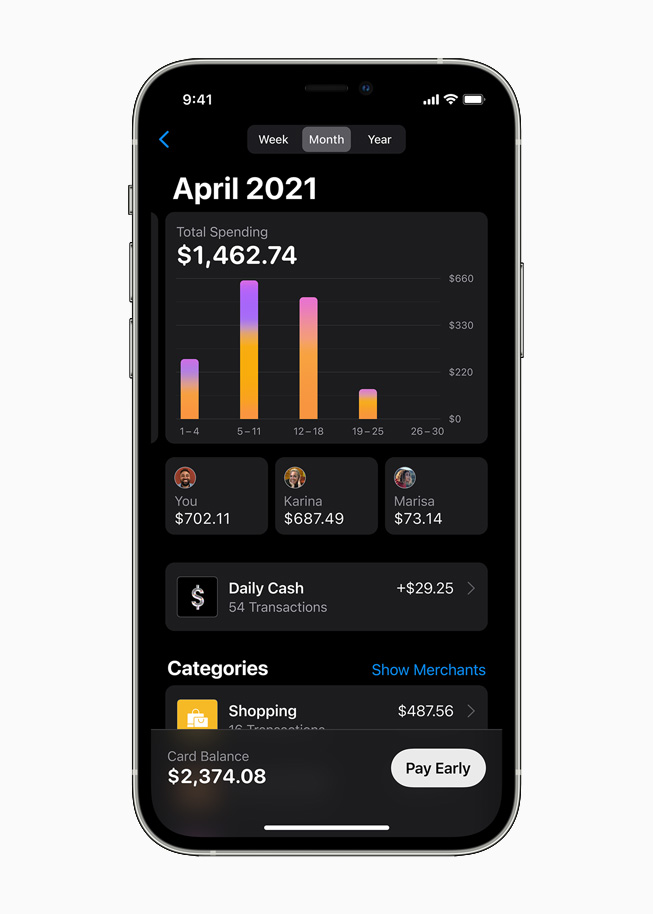

Does the apple card build credit. Why your credit score is used Credit scores can indicate how you use and pay off debt. With Apple Card we completely reinvented the credit card. Plus if you are carrying a balance on other non-iPhone purchases made on the card it will reduce your available credit even further.

You can build credit by opening an account in your name being an authorized user on someone elses account and periodically using the accounts you already own and paying them on time. The Apple Card is a quality cash back credit card for the Apple enthusiast who both has an iPhone and plans to stick within the Apple ecosystem. Apple in August 2019 released the Apple Card a credit card thats linked to Apple Pay and built right into the Wallet app.

Always pay your bills on time keep low or no balances on your cards pay off your balance every month and dont apply for a ton of cards around the time you want to also apply for Apple Card. Does Apple Card Report to the 3 Credit Bureaus I currently dont have any credit cards and I paid off my last student loan several years ago. Designed to live primarily on your phone for making digital payments although cardholders also receive a physical card it promises daily cash with no points and no gimmicks.

The best thing you can do to make sure accepting your your Apple Card offer doesnt affect your credit score in a substantial way is to have a solid credit score built already. We eliminated fees and built tools to help you pay less interest. If used responsibly especially paying your.

If your credit score is low for example if your FICO9 score is lower than 600 4 Goldman Sachs might not be able to approve your Apple Card application. For example if you have a 3000 credit limit on your Apple Card and finance a new 1200 iPhone youll be using 40 of your available credit until you incrementally pay down your balance. And while there is also a physical titanium credit card for purchases outside of Apple Wallet those purchases only earn 1.

The card also includes other Apple Pay security features such as Face ID Touch ID and unique transaction codes making it a. The Apple Card will. If your Apple Card application is declined the process may not have to end there.

Certainly yes a card can help you build credit says John Ulzheimer who has worked at credit bureau Equifax. Certainly yes a card can help you build credit says John Ulzheimer who has worked at credit bureau Equifax and credit analytics company FICO. 1 Advanced technologies like Face ID Touch ID.

For true Apple acolytes Apples own credit card the Apple Credit Card is hard to beat. The Details on the New Apple Card. A path to approval.

Apple offered the card to a select group of users on Aug. For starters if you have an iPhone you can apply for the card in just a few minutes via the. Goldman Sachs uses TransUnion and other credit bureaus to evaluate your Apple Card application.

While some credit cards are designed for those with low or no credit score Apple Card is not built for those scenarios. I am currently looking for an apartment and found out I dont have a Fico score because of no account activity in the past 6 months or more. Getting an Apple Card requires an iPhone as this is the only way to apply.

All credit cards build your credit. How can you use this news to make you money and should you use the Apple Credit Ca. Certainly yes a card can help you build credit says John Ulzheimer who has worked at credit bureau Equifax and credit analytics company FICO.

For now the Apple Card doesnt allow you to include others on your credit card account. 6 2019 with a wider release later in the month. Youd be better served by a secured credit card if youre starting with no credit or working back from bad credit.

Your information lives on your iPhone beautifully laid out and easy to understand. 20655 points iPhoneSpeciality level out of ten. The Apple Credit Card apparently approves even those with terrible credit.

Although Apple Card doesnt charge a late payment fee missing payments can hurt your credit score. The Apple Card reports to TransUnion but does not report to Experian or Equifax. Question marked asApple recommended.

Apples first foray into the credit card market created a product seeded with some appealing features. The physical version of the Apple Card doesnt have a credit card number providing you a little extra security in case your card is stolen. And while the card does feature interest-free financing options for multiple Apple-branded devices and.

Apple Introduces Apple Card Family Enabling People To Share Apple Card And Build Credit Together Apple

Apple Introduces Apple Card Family Enabling People To Share Apple Card And Build Credit Together Apple

Apple Card Family Introduced To Share Card And Build Credit Together Neowin

Apple Card Family Introduced To Share Card And Build Credit Together Neowin

Apple Lets Us Families Build Credit By Sharing Apple Card Accounts Nfcw

Apple Lets Us Families Build Credit By Sharing Apple Card Accounts Nfcw

Apple Card Review How A Credit Card Can Actually Be Different Imore

Apple Card Review How A Credit Card Can Actually Be Different Imore

Apple Card Review How A Credit Card Can Actually Be Different Imore

Apple Card Review How A Credit Card Can Actually Be Different Imore

Does The Apple Card Build Credit Us News

Does The Apple Card Build Credit Us News

Introducing Apple Card A New Kind Of Credit Card Created By Apple Apple

Introducing Apple Card A New Kind Of Credit Card Created By Apple Apple

Apple Introduces Apple Card Family Enabling People To Share Apple Card And Build Credit Together Apple

Apple Introduces Apple Card Family Enabling People To Share Apple Card And Build Credit Together Apple

Apple Introduces Apple Card Family Enabling People To Share Apple Card And Build Credit Together Apple

Apple Introduces Apple Card Family Enabling People To Share Apple Card And Build Credit Together Apple

Apple Lets Couples Co Own Card To Build Credit Together

Apple Lets Couples Co Own Card To Build Credit Together

Your Credit Score Now Affected By Apple Card With All Agencies 9to5mac

Your Credit Score Now Affected By Apple Card With All Agencies 9to5mac

/article-new/2020/06/apple_card_mac_installments_popup.jpg?lossy) Apple Card All The Details On Apple S Credit Card Macrumors

Apple Card All The Details On Apple S Credit Card Macrumors

Apple Card Review How A Credit Card Can Actually Be Different Imore

Apple Card Review How A Credit Card Can Actually Be Different Imore

Apple Is Releasing Its Own Credit Card Should You Get It Grit Daily News

Apple Is Releasing Its Own Credit Card Should You Get It Grit Daily News

Comments

Post a Comment